by Sarah Zhao

Click here to download this report.

This memo explores the evolution of mortgage lending in the United States, with a particular focus on explicating the array of opaque, exotic, and increasingly complex mortgage instruments that emerged after the 1970s in tandem with the deregulation of American finance. The emergence of these mortgage types was one of many contributing factors to the housing bubble that set the stage for the 2008 financial crisis. After clarifying the most common features of subprime mortgages, the memo traces the historical evolution of American residential mortgages more generally, and exotic Adjustable Rate Mortgages in particular.

Adjustable-Rate Mortgage (“ARM”): A mortgage in which the interest rate of the outstanding balance varies across the lifespan of the loan. ARMs are also sometimes known as “floating rate mortgage” or “variable rate mortgage.” ARMs can be conventional or subprime. A big advantage associated with ARMs, which have long been the most common form of residential mortgage outside the United States, is that they protect mortgage lenders from interest rate risk. When interest rates go up, compelling lenders to pay more to attract capital, those who have made ARMs can reset the mortgage interest rate at defined intervals.[1]

In the run-up to the 2008 crisis, however, many ARMs took on characteristics that heightened risks for borrowers. Approximately 80% of U.S. subprime mortgages issued in those years were adjustable-rate mortgages.[2] ARM terms can vary considerably across loans. For example, 2/28 ARMs and 3/27 ARMs are 30-year mortgages consisting of an initial “teaser” rate for the first two or three-years, followed by a higher variable rate. With the most predatory ARMs, borrowers face very high fees, and the loan principal can actually increase over time, resulting in higher payments over the long run.[3]

Balloon Payment Mortgages: A payment schedule that features small initial payments leading to a significantly larger “balloon” payment at the end of the loan. Balloon loans are sometimes called partially or non-amortizing loans, and characterized almost all American residential mortgage lending before the 1930s.[4] As with ARMs, not all balloon payment mortgages are subprime mortgages, but in the run-up to the 2008 crisis, many subprime loans incorporated a balloon payment feature. Balloon mortgage structures vary and can be part of fixed rate, adjustable rate, and interest-only mortgages. The latter type of subprime mortgages, which dramatically reduce monthly payments, grew significantly in popularity before the real estate bubble burst in the mid-2000s.

Fixed Rate Loan: A loan in which the interest rate does not fluctuate with general market conditions. Fixed rate loans tend to have higher initial interest rates than adjustable rate mortgages (ARM), because lenders are not protected against a rise in the cost of loanable funds when they originate a fixed rate loan.[5]

Hybrid ARMs (or “fixed-period ARM”): Similar to standard ARMs, hybrid ARMs begin with an initial fixed interest rate period, with the interest rate adjusting later. Hybrid ARMs include features of both fixed-rate mortgages and adjustable-rate mortgages. Some common examples of hybrid ARMs include the 5/1 Hybrid ARM, which offers an introductory fixed rate for five years, after which the interest rate adjusts annually in sync with prevailing interest rates. Similarly, the 5/6 Hybrid ARM begins with a fixed rate for five years and adjusts every 6 months.

Interest-Only Mortgages: A loan that offers an initial period (usually between 3 to 10 years) where the borrower only pays interest, and thus no part of the principal, before resetting, with the remainder of the loan requiring both principal and interest payments. Most mortgages that offer this interest-only feature are also ARM mortgages with adjustable interest rates.[6]

Prepayment penalties: A penalty paid by some loan borrowers when they repay a loan or mortgage before its scheduled maturity, according to terms specified in the original mortgage agreement. Many states prohibit prepayment penalties; Fannie Mae and Freddie Mac refuse to purchase loans that include them.[7] An estimated 80% of subprime loans contain prepayment penalties (fines charged to the borrower for paying off the loan prior to a contractual period) compared to 2% of conventional loans.[8]

“NINJA” mortgage: NINJA stands for “No Income, No Job, and No Assets.” NINJA mortgages have been widely referenced as a feature of subprime mortgage lending leading up to the financial crisis. To qualify for these loans, a borrower must meet a credit score threshold set by the lending institution with no additional verification of income or assets. NINJA loans typically include a “teaser” rate that later adjusts to a higher variable rate reflecting the underlying credit risk of the borrower. Starting in the years immediately following the financial crisis, legislation such as the Consumer Protection Act and Dodd-Frank Wall Street Reform created stricter requirements for collecting borrower information, thereby pushing NINJA loans nearly into extinction.[9]

No down payment mortgage: A mortgage that does not require borrowers to make a down payment (or requires an exceedingly small down payment). This practice was one feature of subprime mortgage lending leading up to the financial crisis. It is a risky loan for both the borrower and the lender because if housing prices collapse, a borrower can quickly find themselves owing more on a house than it is worth, while a lender faces the prospect of holding a loan in which a borrower holds little or no equity.[10]

Option mortgage: Also known as “pick-a-pay” or payment-option mortgages, this type of adjustable-rate mortgage allows borrowers to choose from different payment options each month. These options include a payment covering interest and principal amounts, a payment that covers only interest, or a minimum payment that does not cover the full interest-only amount.[11]

Refinance: Taking out a new loan to pay off an existing loan. The terms of the existing loan, such as rate, payment schedule, and other terms, are replaced with the terms of the new loan. Borrowers often refinance as interest rates fall, to take advantage of lower rates. Refinancing involves the re-evaluation of a person’s credit and repayment status; it can involve limited or no fees, or alternatively, high fees and restrictive terms. In cases where a property has increased in value, refinancing allows some borrowers to extract equity in the form of a cash payment from the lender. In the run-up to the financial crisis, some mortgage brokers and lenders sought to persuade borrowers to refinance even when it was not in their financial interest to do so.

Subprime Loan (also known as “High-Cost” Loan): A loan typically offered to individuals with low income and/or poor credit, who would normally otherwise have difficulty qualifying for a mortgage. In the run-up to the Great Financial Crisis, there were borrowers who received subprime loans with higher cost terms who could have otherwise qualified for a conventional loan but weren’t aware of that. Subprime loans typically include relatively high fees and higher interest rates, to compensate lenders for higher risk.[12]

Teaser Rate: A teaser rate generally refers to a low, introductory rate. In the years leading up to the financial crisis, some lenders notoriously charged a low initial rate to entice borrowers to take out a loan before rates returned within a few years to a year to normal market levels.

Starting in approximately the 1980s, adjustable rate mortgages (“ARMs”) became more commonplace, in part as response to a high interest rate environment. As interest rates rose, depository institutions had to pay out more in interest to depositors, and as such required that the loans they made also adjusted as interest rates rose. In order to reduce initial monthly payments, some lenders introduced “teaser rate” features. These ARMs differed from traditional fixed-rate mortgages or standard variable rate mortgages because they offered a short-fixed rate for the initial 2 to 5 years (sometimes labeled a “teaser” rate), thereafter resetting to a higher variable rate.

In his oral history interview for the American Predatory Lending project, Philip Lehman describes the emergence of ARMs during his time working as an Assistant Attorney General for North Carolina. Lehman noticed two major changes starting around the late 1980s: first, mortgage brokers began to play a larger role in the marketplace; and (2) second, “plain vanilla loans” gave way to more exotic mortgage loans featuring adjustable rates. Exhibit A[13] is an advertisement in Barron’s National Business and Financial Weekly from 1981, which shows how financial institutions advertised ARMs as a way to help more borrowers obtain a mortgage loan.

A wide variety of ARM structures emerged during the 1990s and especially the 2000s, ranging from interest-only ARMs, option ARMs, hybrid ARMs, and more, all of which allowed households with higher credit risk to more readily access capital, though also heightened risks to those borrowers and the overall financial system. As one example of this, in his oral history interview for the American Predatory Lending project, Assistant Attorney General for Ohio Jeffrey Loeser notes the impact Pay-Option ARMs had in subprime defaults. With these Pay-Option adjustable rate mortgages, borrowers initially pay a tiny interest rate that later resets. Loeser explains that these were harmful as “there was a lot of predatory lending door-to-door [selling] even to consumers [who didn’t understand] what they were doing.” Throughout the 1990s to 2000s, Loeser describes how these types of practices became more commonplace.

Through the early 2000s, subprime lending via exotic ARMs (ARMs with features such as a low two year teaser rate followed by a payment reset) expanded significantly.[14] Subprime mortgage originations increased from $65 billion in 1995 to $173 billion in 2001.[15] From 2001 to 2004, rapid growth in subprime loan origination continued, supplemented by an increase in reliance on in exotic loans.[16] Most notably, from 2004 to 2006, three types of exotic loans – interest-only, option-adjustable-rate-loans (“option ARMs”), and 40-year balloons – increased from 7 percent to 29 percent of the mortgage market according to data from Inside Mortgage Finance.[17] Low interest rates in the early 2000s, a strong economy, and expectations of ever rising house prices, allowed more borrowers with otherwise subpar credit to qualify for these subprime mortgage loans.[18] During the 1980s and 1990s, subprime loans used by borrowers were almost exclusively to refinance existing mortgages, but the portion of subprime mortgage originations taken out as original mortgages increased some over time. For example, by 2006, subprime refinance loans accounted for just over 50 percent of all subprime loans.[19]

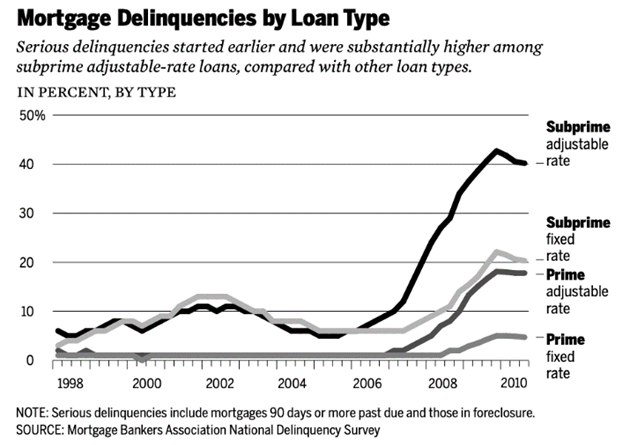

Data analysis conducted by the APL Team noted conventional ARMs had double the delinquency rate of conventional fixed rate mortgages at the height of the financial crisis. In North Carolina, at the peak of the crisis, one in three subprime borrowers with an ARM was delinquent. ARMs were not the sole accelerant of the decline in house prices, rather, it was the combination of ARMs with subprime borrowers and in some cases outright fraud. Data shows subprime fixed rate mortgage delinquency rates largely paralleled subprime adjustable-rate mortgage delinquency rates.

During the run-up to 2008, the prevalence of ARMs in the prime origination market diverged significantly from the prevalence in the subprime market. From 2003 to 2005, ARM mortgages accounted for a modest 10 to 30% of the prime market.[20] However, in the subprime market, ARM loans took a higher share, increasing from a 30% share of subprime mortgages in 1999 – matching the later-observed peak share in the prime market – to approximately 50 percent of the subprime market between 2003 and 2006. It was presupposed that borrowers would refinance these mortgages at the time of rate resets, which was possible to do up through approximately 2004 as house prices increased and interest rates remained low. But as housing prices began to decline thereafter and interest rates on these mortgages increased, there was a wave of payment “shocks” to borrowers, who were unable to make the reset, higher payments and who found themselves unable to refinance. This drove a significant growth in delinquencies, as shown in Exhibit B.[21]

Exhibit C: “Advertisement 48 – no Title.” 1988.Changing Times (1986-1991), 03, 91.

In an American Predatory Lending interview, Al Ripley, a Director in the North Carolina Justice Center since 2003, emphasizes how the introduction of ARMs like the 2/28 ARM and 3/27 ARM confused consumers: “They didn’t understand how the documents worked, they didn’t understand how the loans worked, and they were losing their homes because of it. And so, we started to see more and more cases of that.” Investors in the secondary and tertiary mortgage markets also received marketing that downplayed risks. Exhibit C shows an example of an early advertisement targeted at investors that touted the supposed security of investing in adjustable-rate mortgage funds.

In addition to predatory advertising, subprime products sometimes encouraged predatory lending that disproportionately affected minority communities. Home ownership rates in minority groups did not rapidly pick up until the early 1990s. Legislation such as the 1968 Fair Housing Act (FHA) expanded on the Civil Rights Act of 1964 and made denials of mortgage loans or other real estate transactions based off race or ethnicity illegal.[22] Although this was an influential first step towards broader home ownership by race and ethnicity, the gap between income and house prices still kept millions of families from buying homes. Lenders sought to make housing more affordable by developing subprime mortgage products. These loans often hid high costs, fees, and penalties to create an illusion of affordability. Predatory lending practices and foreclosures disproportionately impacted minority families throughout the United States. As stated in one study on the topic: “[S]ubprime loans are three times more likely in low-income neighborhoods, five times more likely in African-American neighborhoods, and two times more likely in high-income black neighborhoods than in low-income white neighborhoods.”[23] Furthermore, some subprime lenders specifically targeted minority communities and pitched homeowners to refinance into more costly mortgage products as a way of draining the borrower’s home equity, leaving these borrowers worse off.

Since the 1980s, the adoption of adjustable-rate mortgages as a part of the mortgage market has quickly picked up. Exotic features of mortgages loans emerged and included teaser rates, balloon payments, and “pick-a-pay” options. In particular, minority families and individuals more likely to agree to loans with fewer credit requirements and lower down payments were disproportionately impacted by these emergent exotic ARMs. Post-financial crisis, the prevalence of exotic ARMs has fallen significantly. From its highs of a majority of new mortgage originations in the mid-1990s, the ARM share is now less than 10 percent of recent residential mortgage originations.[24]

[1] Downes, John, and Jordan Elliot Goodman. 2018. Dictionary of Finance and Investment Terms.

[2] Singh, Gaurav and Kelly Bruning. 2011. “The Mortgage Crisis Its Impact and Banking Restructure.” Academy of Banking Studies Journal 10 (2): 23-43.

[3] https://www.responsiblelending.org/allies/issue-guide-economic-crisis-financial-reform-sept-2009.pdf

[4] Downes, John, and Jordan Elliot Goodman. 2018. Dictionary of Finance and Investment Terms.

[5] Downes, John, and Jordan Elliot Goodman. 2018. Dictionary of Finance and Investment Terms.

[6] https://www.fdic.gov/consumers/consumer/interest-only/mortgage_interestonly.pdf

[7] Downes, John, and Jordan Elliot Goodman. 2018. Dictionary of Finance and Investment Terms.

[8] Nguyen, T.H. and Pontell, H.N. (2011), “Fraud and Inequality in the Subprime Mortgage Crisis”, Deflem, M. (Ed.) Economic Crisis and Crime (Sociology of Crime, Law and Deviance, Vol. 16), Emerald Group Publishing Limited, Bingley, pp. 3-24.

[9] https://corporatefinanceinstitute.com/resources/knowledge/credit/ninja-loan/

[10] https://www.thebalance.com/no-money-down-loans-why-you-dont-want-one-315659

[11] https://www.law.cornell.edu/wex/option_arm

[12] https://www.valuepenguin.com/loans/what-is-a-subprime-loan

[13] “Advertisement 84 — no Title.” 1981.Barron’s National Business and Financial Weekly (1942-1987), Dec 14, 56.

[14] Financial Crisis Inquiry Commission Report, p.70

[15] Chinloy, P., Macdonald, N. Subprime Lenders and Mortgage Market Completion. J Real Estate Finan Econ 30, 153–165 (2005).

[16] Immergluck, D. From risk-limited to risk-loving mortgage markets: origins of the U.S. subprime crisis and prospects for reform. J Hous and the Built Environ 26, 245-262 (2011).

[17] U.S. Department of Housing and Urban Development. (2010). Report to Congress on the root causes of the foreclosure crisis, January.

[18] https://www.thestreet.com/personal-finance/mortgages/subprime-mortgage-crisis-14704400

[19] https://www.responsiblelending.org/mortgage-lending/research-analysis/Net-Drain-in-Home-Ownership.pdf

[20] Pennington-Cross, Anthony, and Giang Ho. “The Termination of Subprime Hybrid and Fixed-Rate Mortgages.” Real Estate Economics, vol. 38, no. 3, Fall 2010, pp. 399–426. EBSCOhost.

[21] Financial Crisis Inquiry Commission Report, p. 217.

[22] Nguyen, T.H. and Pontell, H.N. (2011), “Fraud and Inequality in the Subprime Mortgage Crisis”, Deflem, M. (Ed.) Economic Crisis and Crime (Sociology of Crime, Law and Deviance, Vol. 16), Emerald Group Publishing Limited, Bingley, pp. 3-24.

[23] Nguyen, T.H. and Pontell, H.N. (2011), “Fraud and Inequality in the Subprime Mortgage Crisis”, Deflem, M. (Ed.) Economic Crisis and Crime (Sociology of Crime, Law and Deviance, Vol. 16), Emerald Group Publishing Limited, Bingley, pp. 3-24.

[24] https://www.newyorkfed.org/medialibrary/media/research/current_issues/ci16-8.pdf